Retirement marks a major life transition, and one of the most confusing changes for many people is how health insurance works once you stop working. Coverage rules shift based on your age, work status, employer size, and whether you’re eligible for Medicare — and those details matter more than most people expect.

While there are general rules about retirement health insurance, there is no single path that applies to everyone. Some people transition directly into Medicare, others rely on COBRA or marketplace coverage for a period of time, and many are unsure whether they need to enroll right away or can safely wait.

Important: This guide is for general educational purposes only and does not provide medical or insurance advice. Medicare rules and coverage options can vary, so always confirm details through Medicare.gov or a licensed professional before making enrollment decisions.

Not sure how this applies to your situation? Everyone’s retirement timeline is different.

Want a quick answer for your exact retirement timeline?

Use our Retirement Insurance Transition Tool to see what typically happens next based on your age, work status, and current coverage. It helps you spot possible coverage gaps before they turn into a problem.

This guide explains the most common retirement health insurance paths so you understand what usually happens — and how to avoid coverage gaps, unexpected costs, and long-term penalties.

The Immediate Impact of Retirement on Your Health Coverage

When you retire, employer-sponsored health insurance usually ends either on your last day of work or at the end of that month, depending on your employer’s policy. Once that coverage ends, you become responsible for securing new health insurance immediately to avoid being uninsured.

If your spouse or dependents were covered under your employer plan, their coverage typically ends at the same time. This can create added urgency and complexity, especially if family members are not yet Medicare-eligible.

Another major change is cost. While working, employers often pay a large portion of health insurance premiums. After retirement, you become responsible for the full cost of coverage, which can significantly increase monthly healthcare expenses. Even a short lapse in coverage can lead to major out-of-pocket costs if unexpected care is needed.

Why Your Age at Retirement Matters More Than You Think

Your age at retirement plays a critical role in determining your health insurance options. Medicare eligibility generally begins at age 65, according to Medicare.gov, which creates three common retirement scenarios — each with different rules and planning considerations.

A. Retiring Before Age 65: Navigating the Coverage Gap

If you retire before age 65, you must find coverage to bridge the gap until Medicare eligibility begins. This gap may last a few months or several years, depending on your retirement age.

This period is especially important because health needs often increase between ages 60 and 64. Having comprehensive coverage during this time helps protect against high medical costs and unexpected emergencies.

Common coverage options before 65 include COBRA continuation coverage, Affordable Care Act marketplace plans, or coverage through a spouse’s employer. Each comes with different costs, timelines, and enrollment rules.

B. Retiring at Age 65: The Medicare Transition

Retiring at age 65 allows for a smoother transition because Medicare eligibility begins at the same time. With proper planning, you can move from employer coverage directly into Medicare without a lapse.

However, this transition still requires attention to enrollment timing. Missing Medicare deadlines can result in delayed coverage and permanent late-enrollment penalties.

C. Working Past Age 65: Coordinating Employer Coverage and Medicare

If you continue working past age 65, your health insurance options depend largely on your employer’s size.

For employers with 20 or more employees, employer coverage generally remains primary, and Medicare enrollment can often be delayed without penalty.

For employers with fewer than 20 employees, Medicare typically becomes primary, and failing to enroll may result in uncovered claims and unexpected bills.

Understanding which coverage pays first is critical to avoiding costly mistakes.

Understanding Medicare: The Foundation of Retirement Health Insurance

Medicare is the primary source of health insurance for most retirees. It consists of several parts, each covering different services.

Medicare Part A helps cover inpatient hospital care, skilled nursing facility care following hospitalization, hospice care, and limited home health services. Most people qualify for premium-free Part A based on work history.

Medicare Part B covers doctor visits, outpatient care, preventive services, and durable medical equipment. Part B requires a monthly premium, and late enrollment can result in lifelong penalties.

Medicare Part C, also called Medicare Advantage, is offered by private insurers and combines Part A and Part B, often including prescription drug coverage. These plans typically involve provider networks and cost-sharing rules.

Medicare Part D helps cover prescription medications. Plans vary widely, so it is important to confirm that your medications are covered at reasonable costs.

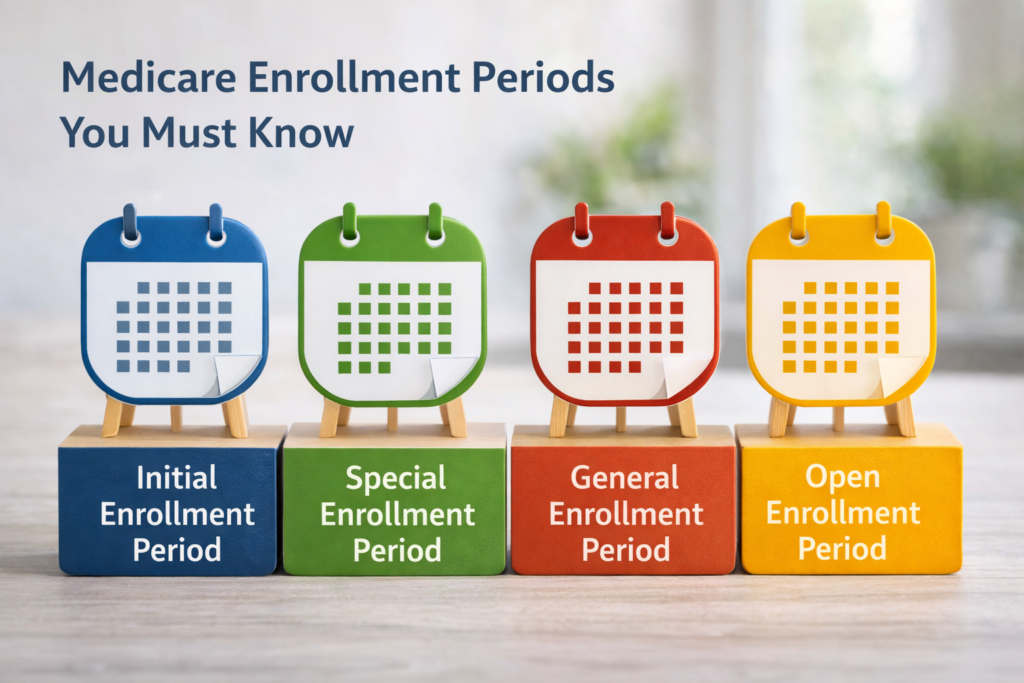

Medicare Enrollment Periods You Must Know

Missing Medicare enrollment deadlines is one of the most costly mistakes retirees make.

The Initial Enrollment Period is a seven-month window surrounding your 65th birthday month. Enrolling early helps prevent coverage delays.

The Special Enrollment Period is available if you or your spouse continue working with qualifying employer coverage. This allows delayed enrollment without penalty, but strict timing rules apply once coverage ends.

The General Enrollment Period applies if earlier windows are missed. Enrollment is limited to January through March each year, with coverage delayed until July and penalties applied.

COBRA: Bridging Coverage Before Medicare

COBRA allows retirees to temporarily continue employer coverage, usually for up to 18 months. While the coverage remains the same, the cost often rises significantly because you pay the full premium plus administrative fees.

COBRA can be useful as a short-term bridge, but it is often expensive and not intended as a long-term solution.

Important: If you are Medicare-eligible, COBRA does not replace Medicare enrollment. Failing to enroll in Medicare while relying on COBRA can result in denied claims, penalties, or COBRA ending sooner depending on timing.

Affordable Care Act Marketplace Coverage

For early retirees, ACA marketplace plans may provide a more affordable alternative to COBRA, especially for those eligible for premium tax credits.

Retirement qualifies as a special enrollment event, allowing enrollment outside the annual open enrollment period. However, marketplace coverage does not count as creditable coverage for Medicare, meaning Medicare enrollment must still occur on time at age 65.

Medicare Supplemental Coverage: Filling the Gaps

Original Medicare does not cover all healthcare costs, which is why many retirees explore additional coverage.

Medigap, also called Medicare Supplement Insurance, helps cover deductibles, coinsurance, and copayments not paid by Medicare. The best time to enroll is during the six-month Medigap Open Enrollment Period that begins with Part B enrollment.

Some employers offer retiree health benefits that work alongside Medicare. These plans vary widely and should be compared carefully against other options.

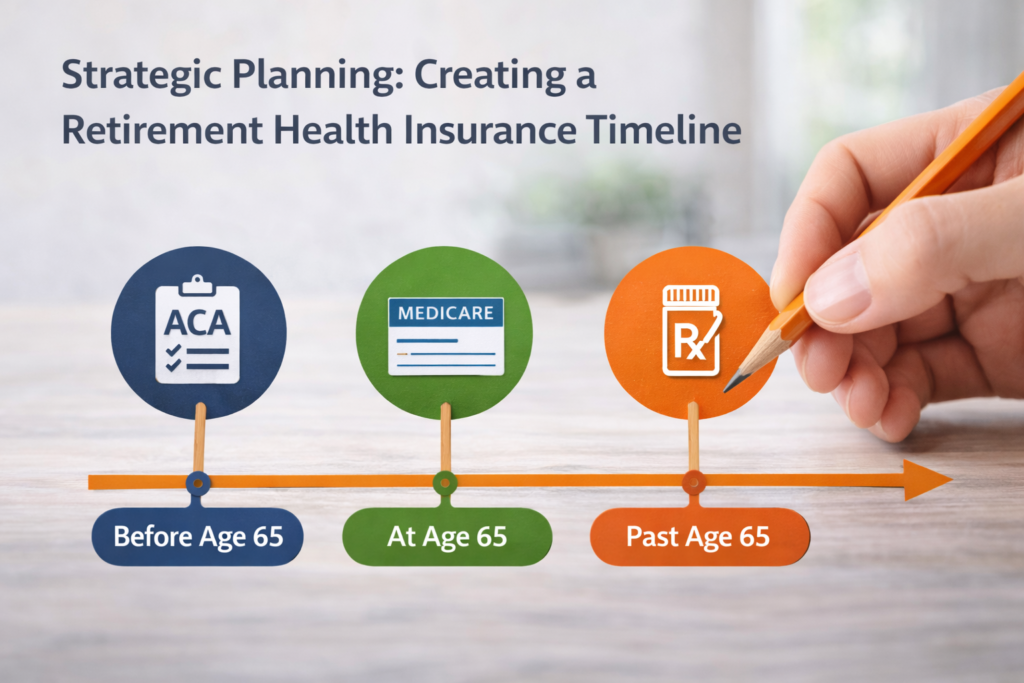

Strategic Planning: Creating a Retirement Health Insurance Timeline

Planning early helps avoid rushed decisions and costly coverage mistakes.

Twelve months before retirement, review employer benefits, estimate healthcare costs, and learn Medicare basics.

Six months before retirement, compare COBRA versus marketplace plans, review Medicare options if eligible, and confirm that preferred doctors accept your future coverage.

Three months before retirement, enroll in Medicare if applicable, secure bridge coverage if under 65, and coordinate spousal coverage if needed.

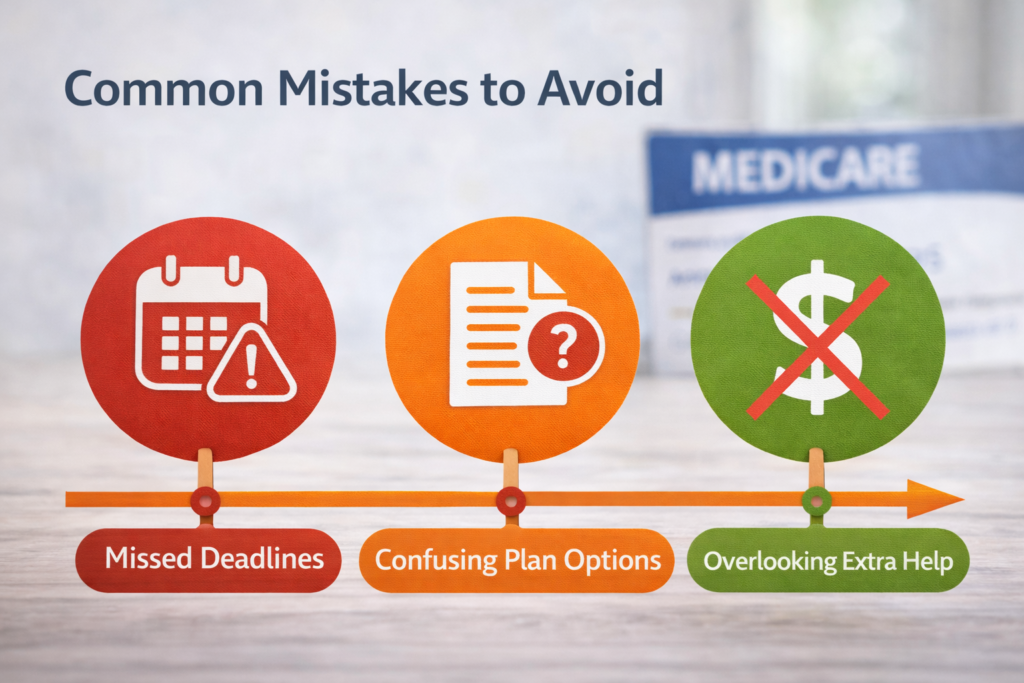

Common Mistakes to Avoid

Many retirees run into trouble by missing Medicare enrollment deadlines, assuming COBRA replaces Medicare, overlooking prescription drug coverage details, or failing to coordinate coverage for a spouse.

These mistakes can lead to permanent penalties and unnecessary out-of-pocket expenses.

Final Thoughts: Turning Information Into Action

Understanding how health insurance works in retirement helps you avoid costly mistakes, but the most important step is applying that information to your own situation. Small differences in age, work status, and prior coverage can change what happens next.

Rather than trying to memorize every rule, focus on understanding where you are in the transition and what typically follows.

👉 Our Retirement Insurance Transition Tool helps you quickly see how retirement usually affects coverage for someone in your situation — and what to review before making enrollment decisions.

Want a quick answer for your exact retirement timeline?

Use our Retirement Insurance Transition Tool to see what typically happens next based on your age, work status, and current coverage. It helps you spot possible coverage gaps before they turn into a problem.

Health insurance in retirement isn’t a one-time choice. Review your coverage regularly, stay aware of enrollment periods, and adjust as your needs change.

Additional Tools

- Medicare Timing Tool

- Medicare Coverage Gap Detector

- Retirement Insurance Transition Tool (already included)

Frequently Asked Questions

Do I lose my health insurance the day I retire?

Most employer plans end on your last day of work or at the end of the month, so it’s important to confirm timing with your benefits office.

Can I stay on my employer plan after retirement?

Some employers offer retiree coverage, but many do not. If offered, it usually works alongside Medicare.

Is COBRA a good option if I’m close to 65?

COBRA can help bridge short gaps, but it can be expensive and does not replace Medicare enrollment when you become eligible.

What happens if I miss Medicare Part B enrollment?

Missing Part B enrollment can lead to lifelong late penalties and delayed coverage unless you qualify for a Special Enrollment Period.

Does my spouse lose coverage when I retire?

If they were covered under your employer plan, their coverage typically ends at the same time, so planning is essential.