By 60AndOver.net – Updated for 2025

Why Medicare Costs Matter More Than Ever After 60

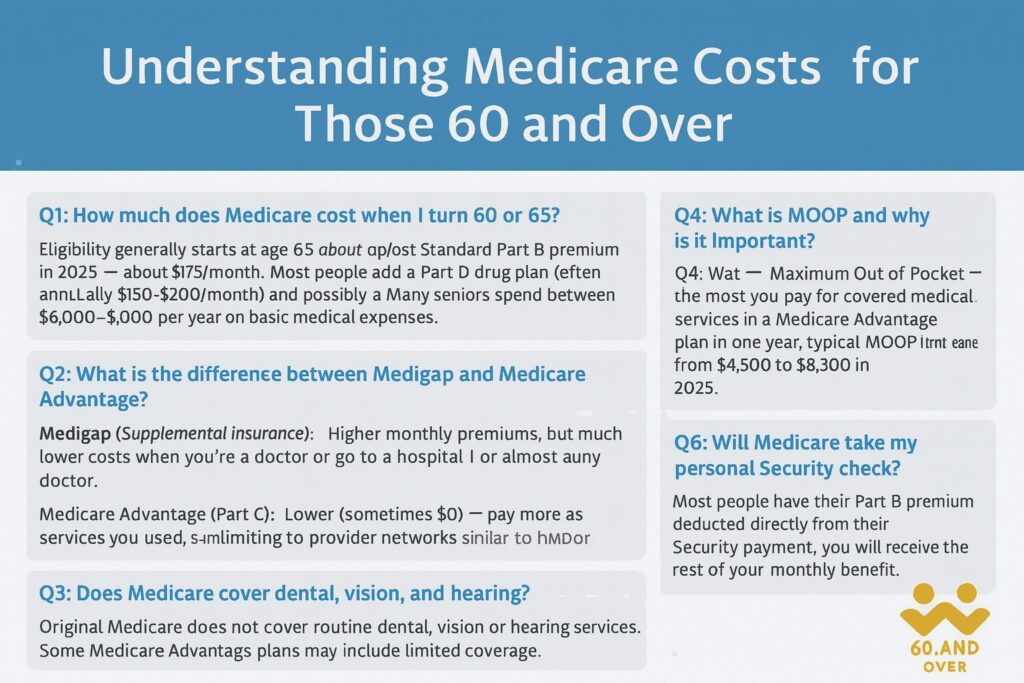

Turning 60 marks a major milestone in life. Retirement planning becomes real, Social Security is closer, and healthcare often moves to the top of the priority list. For millions of Americans, Medicare is the foundation of healthcare coverage after age 65.

But here’s the truth: Medicare is not free. Between premiums, copays, prescription drug costs, and services not covered at all, seniors can spend thousands each year. According to recent studies, the average couple retiring at 65 will need over $300,000 just for healthcare expenses throughout retirement.

That number shocks many — and it’s exactly why understanding Medicare costs now, before you enroll, can save you money and stress later.

This guide breaks down everything seniors 60+ need to know about Medicare costs in 2025, from premiums to hidden expenses, and how to budget wisely. By the end, you’ll have a clear picture of what Medicare may cost you — and how to protect your retirement savings.

Medicare Cost Basics: The Building Blocks

Medicare is divided into four parts. Each has its own costs, and together they form the puzzle you’ll need to put together.

Part A – Hospital Insurance

- Most people get Part A premium-free (if you or your spouse worked 40+ quarters).

- Deductible in 2025: $1,632 per benefit period.

- Hospital copays kick in after 60 days ($408 per day from days 61–90, then $816 per day for “lifetime reserve days”).

Part B – Medical Insurance

- Standard premium in 2025: about $175/month.

- Deductible: $250 annually.

- You pay 20% coinsurance for most services (doctor visits, outpatient care, durable medical equipment).

Part D – Prescription Drug Plans

- Premiums vary by plan, but average around $45/month in 2025.

- Deductible: up to $545.

- Copays vary by tier (generic vs brand vs specialty).

Medicare Advantage (Part C)

- Combines Parts A, B, and often D.

- Premiums can be $0 to $100+/month.

- Each plan sets its own copays, deductibles, and maximum out-of-pocket (MOOP), usually $4,500–$8,300.

Medigap (Supplemental Insurance)

- Covers the 20% coinsurance Original Medicare leaves behind.

- Premiums vary widely, but a typical Medigap Plan G costs $150–$200/month.

- Helps protect against big medical bills.

💡 Quick math for the average senior in 2025:

- Part B premium = $175/month ($2,100/year)

- Medigap premium = $150/month ($1,800/year)

- Part D premium = $45/month ($540/year)

- Typical prescription and medical copays = $1,500/year

Estimated yearly Medicare cost = $6,000+ per person.

Original Medicare vs Medicare Advantage: Which Costs More?

Seniors often ask: “Which is cheaper, Medigap or Medicare Advantage?” The answer depends on your health and how often you use care.

Original Medicare + Medigap + Part D

- Higher monthly premiums (often $300–400 combined).

- Very low out-of-pocket costs when you use care.

- Nationwide coverage, no networks.

- Predictable budgeting.

Medicare Advantage (MA-PD)

- Lower (sometimes $0) premiums.

- Higher copays for doctor visits, hospital stays, ER, and outpatient procedures.

- Must use in-network providers.

- Has a MOOP to cap annual costs.

👉 For healthy seniors who rarely visit the doctor, Advantage may look cheaper upfront. But for those with chronic conditions or high medical use, Medigap usually saves money in the long run.

Hidden Medicare Costs Seniors Don’t Expect

Even with full Medicare coverage, there are costs many 60+ retirees overlook:

- Dental, Vision, Hearing – Not covered by Original Medicare. Advantage plans may offer limited benefits, but crowns, hearing aids, and glasses are often out-of-pocket.

- Prescription Donut Hole – After you and your plan spend $5,030 on drugs in 2025, you pay up to 25% of costs until catastrophic coverage kicks in.

- Long-Term Care – Medicare does not cover nursing homes or assisted living beyond short rehab stays. This is one of the biggest retirement shocks.

- IRMAA Surcharges – If your income is above $103,000 (single) or $206,000 (married), you’ll pay extra premiums for Part B and Part D.

Estimating YOUR Costs: Step-by-Step

Every senior’s Medicare costs look different. The best way to prepare is to estimate your own annual spending.

- Add your monthly premiums (Part B, Part D, Medigap or MA).

- Estimate your yearly healthcare use (doctor visits, ER, hospital, outpatient).

- Multiply by typical copays/coinsurance.

- Add your monthly prescription costs.

- Factor in extra services (dental, hearing, vision).

👉 Or, save time and use our Medicare Cost Estimator Tool to get a personalized estimate in under 2 minutes.

How Seniors Can Lower Medicare Costs

Good news: you don’t have to accept Medicare’s price tag without a fight. Here are proven strategies to reduce costs:

- Shop During Open Enrollment (Oct 15 – Dec 7): Plans change premiums and copays yearly. Switching can save $500–$1,000.

- Use Preventive Care: Annual wellness visits, screenings, vaccines = free. Preventing illness saves money.

- Apply for Extra Help: If income is under ~$22,000 (single), Medicare may cover most drug costs.

- Check Medicare Savings Programs: May pay your Part B premium if your income is limited.

- Pharmacy Hacks: Switch to generics, ask for 90-day mail order, and use preferred pharmacies for lower copays.

- Wellness Savings: Advantage plans often include gym memberships (SilverSneakers) and telehealth at no extra cost.

FAQs Seniors Ask Most

Q: Will Medicare take all my Social Security check?

A: No, but Part B premiums are automatically deducted. Most seniors see about $175/month come out.

Q: What if I delay Part B?

A: Unless you have employer coverage, you’ll face a 10% penalty for every 12 months you delay.

Q: Does Medicare cover assisted living or nursing homes?

A: No. Medicare only covers short-term rehab stays. Long-term care is private pay, Medicaid, or long-term care insurance.

Q: How much should I budget for healthcare in retirement?

A: Experts suggest $6,000–$8,000 per year per person. Couples should plan for at least $15,000 annually.

Final Thoughts: Take Control of Your Medicare Costs

Medicare is the backbone of senior healthcare, but it’s not one-size-fits-all. Costs vary based on your health, plan choice, and prescriptions. The key is planning ahead — not being surprised by bills.

At 60AndOver.net, our mission is to make Medicare simple. Use our Medicare Cost Estimator Tool to get your personalized estimate today and start planning for a confident, stress-free retirement.