If you’ve ever watched daytime television or browsed the mail, you’ve probably seen ads for the Colonial Penn $9.95 Plan. The message sounds reassuring: affordable life insurance, guaranteed acceptance, and no medical questions. For many adults over 60, that promise naturally raises an important question.

Is it really $9.95 a month? And what do you actually get?

This guide walks through how the Colonial Penn $9.95 Plan works, what it covers, what it doesn’t, and the details seniors should understand before making a decision. The goal here isn’t to sell or dismiss the plan, but to explain it clearly so you can decide whether it fits your situation.

What the Colonial Penn $9.95 Plan Actually Is

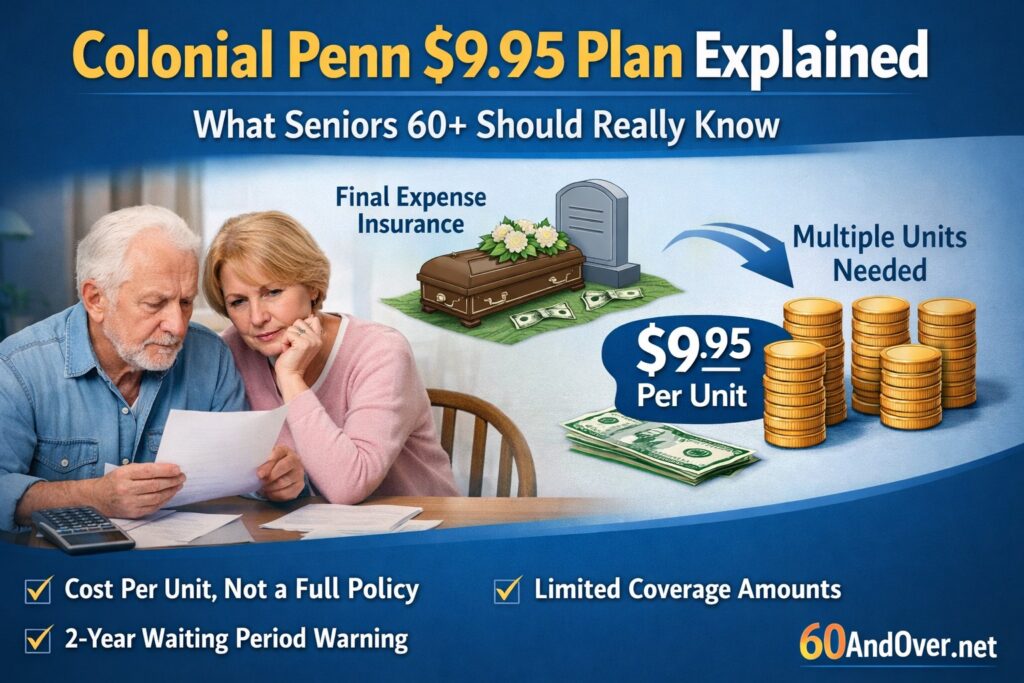

Despite how it’s often described in advertising, the $9.95 Plan is not a full life insurance policy with a fixed dollar amount. Instead, it is a guaranteed acceptance whole life insurance plan sold in “units.”

Each unit costs $9.95 per month.

You choose how many units to buy, up to a maximum set by the company. The number of units you purchase determines your total monthly cost and your eventual death benefit.

This type of insurance is commonly referred to as final expense insurance, designed to help cover funeral costs, burial or cremation expenses, and small outstanding bills.

Understanding “Units” (This Is the Part Most Ads Skip)

This is where confusion often starts.

A unit is not a set amount like $1,000 or $5,000. The value of each unit depends on your age, gender, and state at the time you enroll.

In general:

- Younger applicants receive more coverage per unit

- Older applicants receive less coverage per unit

For example (approximate figures, which vary by state):

- Someone in their early 60s might receive over $1,000 of coverage per unit

- Someone in their mid-70s might receive around $500 per unit

- Someone in their 80s may receive only a few hundred dollars per unit

That means while the price per unit stays the same, the coverage amount decreases as age increases.

This is why many seniors discover that $9.95 per month only buys a small amount of coverage, especially later in retirement.

How Monthly Costs Add Up

Because coverage is sold in units, most people purchase more than one.

Here’s how that looks in practice:

- 1 unit = $9.95 per month

- 5 units = $49.75 per month

- 10 units = $99.50 per month

- 20 units = $199.00 per month

The total cost depends on how much coverage you want and how much each unit is worth at your age.

For seniors looking to cover the average funeral cost, this often means multiple units, not just one.

Guaranteed Acceptance: A Key Advantage

One of the strongest features of the Colonial Penn plan is guaranteed acceptance.

There are:

- No medical exams

- No health questionnaires

- No approval based on medical history

If you fall within the eligible age range and can pay the premium, you cannot be turned down.

For seniors with serious health conditions or those who have been denied coverage elsewhere, this alone can make the plan appealing.

The Two-Year Waiting Period (Important to Understand)

The Colonial Penn $9.95 Plan includes a graded benefit period, sometimes called a waiting period.

During the first two years:

- If death occurs from natural causes, the policy typically refunds premiums paid, plus interest

- If death occurs due to an accident, the full benefit is usually paid

After the two-year period:

- The full death benefit is paid for any covered cause

This waiting period is common among guaranteed acceptance policies, but it’s essential to understand. The plan is designed for long-term planning, not immediate full coverage.

Lifetime Coverage and Fixed Premiums

As long as premiums are paid:

- Coverage lasts for life

- Monthly costs do not increase

- The policy does not expire at a certain age

This predictability can be reassuring for retirees on fixed incomes who value stable expenses.

The policy also builds cash value over time, which can be borrowed against if needed. However, loans reduce the eventual death benefit.

When the Colonial Penn $9.95 Plan Can Make Sense

This plan may be appropriate if:

- You have health conditions that prevent qualifying for traditional life insurance

- Guaranteed acceptance is your top priority

- You understand the waiting period and limited coverage per unit

- Your goal is modest final-expense support, not a large inheritance

For some seniors, access and certainty matter more than maximum value.

When Seniors May Want to Compare Other Options

The plan may be less ideal if:

- You are in relatively good health and can qualify for simplified or fully underwritten policies

- You want immediate full coverage with no waiting period

- You need higher coverage amounts at a lower monthly cost

Many seniors who qualify medically can find policies that provide more coverage for the same or lower premium, especially earlier in retirement.

Why the Advertising Can Feel Confusing

The $9.95 price point is technically accurate, but it represents one unit, not a complete policy.

This isn’t deceptive by definition, but it can feel misleading if the unit structure isn’t explained upfront. Understanding that distinction helps avoid disappointment or confusion later.

A Practical Takeaway for Seniors

You don’t need to decide immediately after seeing an ad.

Before enrolling:

- Ask how much coverage one unit provides at your age

- Calculate how many units you’d need to meet your goals

- Confirm the waiting period details in writing

- Compare at least one alternative policy if possible

Life insurance decisions are easier when the numbers are clear and expectations are realistic.

Final Thoughts

The Colonial Penn $9.95 Plan is a legitimate guaranteed acceptance life insurance option, but it is not a one-size-fits-all solution. The real value depends on age, health, budget, and how much coverage you actually need.

For some seniors, it provides peace of mind when other doors are closed. For others, it may be worth comparing additional options before deciding.

Understanding the structure is the most important step, and now you have it.

Frequently Asked Questions About the Colonial Penn $9.95 Plan

Is the Colonial Penn plan really only $9.95 per month?

The $9.95 price applies to one unit of coverage, not a full life insurance policy. Most seniors need multiple units to reach meaningful final expense coverage, which increases the monthly cost.

What does one unit of coverage provide?

The value of one unit depends on your age, gender, and state. Younger applicants receive more coverage per unit, while older applicants receive less. There is no fixed dollar amount per unit.

Is acceptance truly guaranteed?

Yes. The Colonial Penn $9.95 plan offers guaranteed acceptance within the eligible age range. There are no medical exams or health questions required to qualify.

Is there a waiting period before full benefits apply?

Yes. The policy typically includes a two-year waiting period for natural causes of death. During this time, premiums paid are usually refunded with interest. Accidental death is generally covered immediately.

Does the policy last for life?

As long as premiums are paid, the coverage remains in force for life. Premiums are fixed and do not increase over time.

Does this plan build cash value?

Yes. The policy builds cash value over time, which may be borrowed against. However, any loans taken will reduce the death benefit paid to beneficiaries.

Who is this plan best suited for?

This plan may be appropriate for seniors who cannot qualify for traditional life insurance due to health concerns and who want guaranteed acceptance for modest final expense planning.

Want to compare Colonial Penn with other senior-focused life insurance providers?

Visit our Life Insurance Providers for Seniors Hub to see how different companies structure coverage, pricing, and eligibility for adults 60 and over.