Traveling in your golden years should be a rewarding and worry-free experience. However, unexpected events such as medical emergencies, trip cancellations, or lost luggage can turn an enjoyable trip into a stressful one.

That’s where travel insurance comes in—it provides peace of mind and financial protection. But with so many options available, how do you choose the right travel insurance as a senior traveler? This guide will help you navigate the key considerations and find a policy that fits your needs.

Why Travel Insurance is Essential for Seniors

As we age, travel insurance becomes more than just an extra precaution—it’s a necessity. Here’s why:

- Medical Coverage: Seniors are more likely to require medical attention while traveling. Without insurance, international healthcare costs can be extremely high.

- Trip Cancellations & Interruptions: Life is unpredictable. If you have to cancel a trip due to illness or an emergency, travel insurance helps recover non-refundable expenses.

- Lost or Delayed Luggage: Seniors often travel with important medications or mobility aids. Coverage ensures replacements are provided if luggage is lost or delayed.

- Emergency Evacuations: If you need to be transported to a medical facility or back home, insurance can cover these substantial costs.

Key Features to Look for in Senior Travel Insurance

When selecting a policy, keep these essential features in mind:

1. Comprehensive Medical Coverage

- Ensure the policy covers pre-existing medical conditions.

- Look for high coverage limits for hospital stays and doctor visits.

- Consider policies that include emergency dental care.

2. Trip Cancellation and Interruption Coverage

- Check what reasons are covered for cancellations.

- Ensure the policy reimburses for non-refundable expenses.

3. Coverage for Pre-Existing Conditions

- Many policies have exclusions for pre-existing conditions, but some offer coverage if you meet certain requirements.

- Look for policies that offer a pre-existing condition waiver.

4. Emergency Medical Evacuation and Repatriation

- If you’re traveling to remote locations, evacuation coverage is crucial.

- Check if the policy covers transportation back to your home country for treatment.

5. Baggage and Personal Belongings Protection

- Covers lost, stolen, or delayed baggage.

- Consider additional coverage if traveling with expensive medical equipment or valuables.

6. 24/7 Assistance Services

- A good policy should provide access to emergency assistance around the clock.

- Services may include help with lost passports, medical referrals, or translation services.

How to Choose the Best Policy

- Assess Your Travel Needs: Consider the type of trip you’re taking—whether it’s a short domestic getaway or an extended international stay.

- Compare Plans: Use travel insurance comparison websites to evaluate policies from different providers.

- Read the Fine Print: Understand what is and isn’t covered, especially regarding pre-existing conditions and claim limitations.

- Check Age Limits: Some insurers have age restrictions, so ensure you qualify for coverage.

- Look for Senior-Friendly Providers: Some insurers specialize in travel insurance for older travelers and offer tailored benefits.

- Consider Annual vs. Single-Trip Policies: If you travel frequently, an annual policy may be more cost-effective.

Best Travel Insurance Providers for Seniors

While options vary by country, here are some well-regarded providers known for offering solid coverage for senior travelers:

- Allianz Global Assistance

- Travel Guard by AIG

- InsureMyTrip (Comparison site)

- World Nomads (For adventure travelers)

- Medjet Assist (Specializes in medical evacuation)

Final Thoughts

Choosing the right travel insurance as a senior doesn’t have to be overwhelming. By understanding your needs, comparing policies, and reading the details carefully, you can find a plan that ensures a worry-free trip.

Travel should be about making memories—not worrying about what could go wrong. With the right insurance, you can embark on your adventures with confidence and peace of mind.

Other Articles

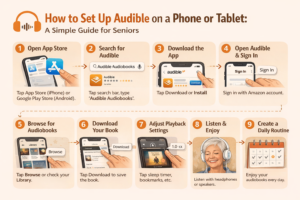

How to Set Up Audible on a Phone or Tablet: A Step-by-Step Guide for Seniors

Getting started with Audible does not require technical experience. If you can use a phone to make calls, send messages, or browse the internet, you can set up Audible. This

How to Navigate Online Dating Over 60 (2026 Guide to Meaningful Connections)

Dating after 60 often comes with mixed emotions — excitement, nerves, and a little uncertainty about where to start. The good news is that online dating has completely transformed the

The Best Senior-Friendly Cruises for Relaxing Getaways

Cruising is one of the best travel options for seniors looking for a stress-free and comfortable vacation. With all-inclusive amenities, easy mobility, and plenty of entertainment, cruises provide the perfect

How Ramelteon Works: A Safer Prescription Sleep Aid for Seniors

Understanding How This Melatonin-Based Medication Helps With Sleep For many seniors, getting a good night’s sleep is a challenge. Trouble falling asleep — known as sleep-onset insomnia — is especially

Why Frequent Urination Quietly Disrupts Sleep for Men?

Waking up multiple times during the night to use the bathroom can be frustrating, exhausting, and confusing. Many men find that even when they fall asleep easily, their rest is

Smart Grocery Shopping Tips for One or Two: Save Money, Reduce Waste, and Eat Well

Grocery shopping for just one or two people can be surprisingly challenging. Packages are often designed for families, produce spoils faster than you expect, and it’s easy to overspend on