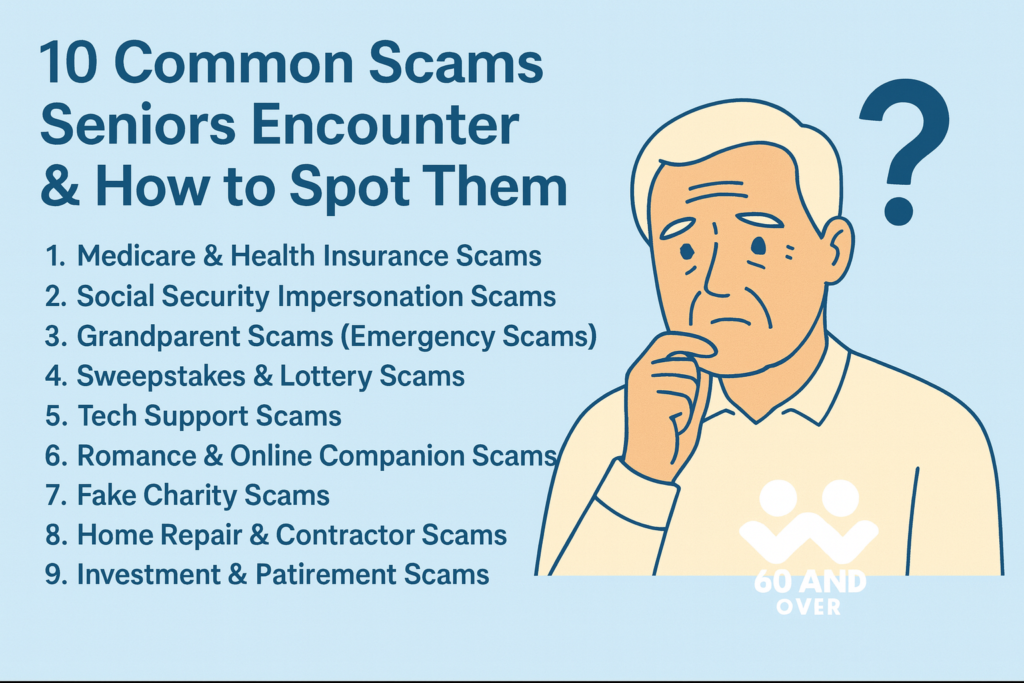

Staying safe in today’s digital and financial world can feel overwhelming, especially when scams are becoming more convincing and harder to detect. Older adults are often targeted because scammers assume they’re polite, trusting, or unfamiliar with fast-changing technology. But understanding how these scams work — and knowing the early signs — can stop fraud long before it harms your finances or peace of mind.

This guide breaks down the most common scams seniors face, why they work, and how to spot the warning signs quickly.

1. Medicare & Health Insurance Scams

Fraudsters know that healthcare is a sensitive topic for older adults, so they impersonate Medicare agents or insurance providers to gain personal information. They may claim you need a “new card,” “updated file,” or “urgent policy validation.” The moment they ask for your Medicare number, banking information, or Social Security number — it’s a scam.

👉 Spot It: Real Medicare will never call unexpectedly. Hang up and call Medicare directly at 1-800-MEDICARE.

2. Social Security Impersonation Scams

Scammers often use threats such as “your benefits will be suspended” or “your Social Security number has been compromised.” These calls can sound official because scammers spoof real government phone numbers.

Spot It: The Social Security Administration does not suspend benefits by phone and will not demand immediate payment or personal details.

3. Grandparent Scams (Emergency Scams)

These scams take advantage of a grandparent’s natural instinct to protect their family. A caller pretends to be a grandchild who is scared, injured, arrested, or stranded in another state or country. Their voice may sound different, and when you question it, they often blame a cold, injury, or bad connection.

They beg you not to tell anyone — especially parents — and they create pressure by insisting they need money right now. Scammers usually request payment through gift cards, wire transfers, or cash sent by courier, because these methods can’t be traced.

👉 Spot It: Always verify the story before reacting. Hang up and call your grandchild or their parent directly using a number you already know. A true emergency can always be confirmed — and a scammer will push you to act before you check.

4. Sweepstakes & Lottery Scams

“You’ve won!” is a phrase scammers use to hook victims quickly. They then ask for “processing fees” or “taxes” before sending your prize, which never arrives. Many seniors lose thousands because the scam feels exciting, friendly, and urgent.

Spot It: If you didn’t enter a contest, you didn’t win. Legitimate sweepstakes never ask for payment to release winnings.

5. Tech Support Scams

A pop-up warning may suddenly flash on your screen saying your computer is infected, or someone might call pretending to be from Microsoft, Apple, or another “tech support” team. They often sound urgent and professional, pressuring you to act quickly or allow them remote access to “fix the problem.”

Once they’re in, scammers can steal passwords, view private information, or install harmful software without you realizing it.

👉 Spot It: Real companies never call you about viruses or send pop-ups asking for access. Close the pop-up immediately, restart your device, and never let anyone you don’t know remotely control your computer. If you’re unsure, call a trusted family member or your actual device provider directly — using the phone number from their official website, not from the pop-up.

6. Romance & Online Companion Scams

These scams take advantage of loneliness, trust, and the desire for meaningful connection. A scammer builds a relationship online, then claims they need money for travel, medical bills, or to “finally meet in person.” Seniors often feel embarrassed afterward, but these scams are extremely common and emotionally manipulative.

Spot It: Anyone you haven’t met in person who asks for money — for any reason — is not who they claim to be.

7. Fake Charity Scams

During holidays, natural disasters, or any major crisis, scammers often set up fake charities to take advantage of people’s kindness. They may use heartbreaking stories, convincing photos, official-looking logos, or urgent pleas for “immediate help” to pressure you into donating. Some even spoof real organizations by copying their names or designs.

👉 Spot It: Never feel rushed to give. Real charities don’t demand instant donations. Before sending money, look up the organization on CharityNavigator.org or the IRS’s Tax-Exempt Organization Search to confirm it’s legitimate. If the charity can’t be verified, don’t donate.

8. Home Repair & Contractor Scams

Seniors who own homes often get targeted by people offering driveway paving, roofing work, appliance repairs, or “free inspections.” These scammers disappear after taking money or do poor-quality work that creates even bigger problems.

Spot It: Never hire someone who knocks on your door uninvited. Always get written estimates and verify licensing.

9. Investment & Retirement Scams

Fraudsters promise seniors “guaranteed returns,” “risk-free investments,” or “exclusive opportunities.” Many pose as financial advisors or use complicated jargon to sound credible. Once money is transferred, it’s gone.

Spot It: No legitimate investment is risk-free. Always consult a real, licensed advisor before sending funds.

10. Online Shopping & Package Delivery Scams

Fake websites, incorrect delivery notices, and “problem with your order” emails are designed to steal credit card numbers. Seniors who shop online for convenience are often targeted with phishing emails disguised as Amazon, UPS, or USPS alerts.

Spot It: Don’t click links in emails. Check your account directly through the official website instead.

How Seniors Can Stay Protected Every Day?

Protection isn’t about becoming fearful — it’s about recognizing patterns. Scammers depend on urgency, secrecy, and emotional pressure. When something feels rushed or unusual, slow down. Verify before responding.

And never feel ashamed of hanging up, asking questions, or calling a trusted friend for a second opinion.

👉 Staying informed is the strongest shield against fraud.

When to Report a Scam

If you’ve been targeted or think you shared information accidentally, report it quickly.

- Federal Trade Commission (FTC): ReportFraud.ftc.gov

- AARP Fraud Watch Network: 1-877-908-3360

- Local Police (for financial losses)

Reporting helps prevent the same scam from reaching someone else.

SENIOR SCAM & PROTECTION TOOL

Find Official Scam Reporting Instructions

Select the type of scam and your state to receive the correct, government-verified reporting steps.

Printable Scam Emergency Checklist

- Stop all communication immediately.

- Do not send money, gift cards, or personal information.

- Write down details of the scam attempt.

- Contact your bank if financial info was shared.

- Change passwords for email and banking.

- Report the scam using the instructions above.

Tool powered by 60AndOver.net

Final Thoughts

Scammers are clever, but you are smarter — especially when you know what to look for. By trusting your instincts, slowing down, and learning the warning signs, you protect not only your finances but also your independence and confidence.

Keep this guide handy, share it with friends, and revisit it anytime something doesn’t feel right.

FAQ: Common Scams Seniors Encounter

1. How do I know if a phone call is a scam?

Most scam calls begin with urgency — someone claiming you owe money, your benefits are at risk, or your account has a problem. Government agencies like Medicare and Social Security do not call out of the blue to request information. If the caller pressures you, threatens you, or asks for personal details, it’s a scam.

2. What should I do if someone claims to be my grandchild in trouble?

Scammers often pretend to be a grandchild who needs emergency money. If you get a call like this, pause and verify by contacting the family directly. Scammers rely on fear and secrecy, so it’s perfectly safe to hang up and check.

3. What are the warning signs of an online scam?

Look for poor spelling, unusual email addresses, “problem with your order” messages you weren’t expecting, or websites that feel unfamiliar. If someone asks for remote access to your device or immediate payment, stop immediately and verify through the official website.

4. How can I protect myself from fake charities?

Before you donate, search the charity on CharityNavigator.org or the IRS nonprofit list. Be cautious of anyone demanding money on the spot or pressuring you with sad stories without providing verification.

5. Where do I report a scam if I think I’ve been targeted?

You can report fraud to the Federal Trade Commission at ReportFraud.ftc.gov. If you lost money, call your bank right away and notify your local police. AARP’s Fraud Watch Network Helpline (1-877-908-3360) is also available to guide you through next steps.

Return to the Fraud & Safety Hub

Stay Confident. Stay Protected.

If you found this guide helpful, you’ll find even more support inside our full Senior Scam & Protection Hub.

Explore step-by-step guidance, senior-friendly explanations, and updated alerts on the newest scams targeting older adults.

👉 Visit the Fraud & Safety Hub

https://60andover.net/senior-scam-protection/

Important Reminder for Your Safety

Scammers are constantly changing their tactics, and the most effective way to protect yourself is to slow down, verify, and trust your instincts.

No legitimate agency will:

• demand immediate payment

• request personal information by phone

• ask for gift cards, wire transfers, or prepaid cards

If something feels off — even slightly — pause and confirm with a trusted family member or call the organization directly using a phone number you already know.

Your safety is worth taking an extra moment.