Retirement is a time to enjoy the fruits of your labor, but without proper tax planning, your hard-earned savings can quickly diminish. Taxes in retirement can be more complex than expected, but with the right strategies, you can minimize your tax burden and make your money last longer. This guide will explore key tax-saving tips tailored for retirees to help you preserve more of your income.

Understanding Retirement Taxes

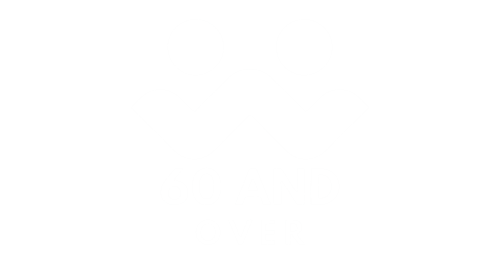

When planning for taxes in retirement, it’s essential to understand how your income sources are taxed. Common retirement income streams include:

- Social Security Benefits: Depending on your income level, up to 85% of your Social Security benefits may be taxable.

- Traditional IRA and 401(k) Withdrawals: These are typically taxed as ordinary income.

- Roth IRA Withdrawals: Withdrawals are generally tax-free if certain conditions are met.

- Pensions: Most pensions are taxed as ordinary income unless you contributed post-tax dollars.

- Investment Income: Dividends, capital gains, and interest may be subject to various tax rates.

Retirement income often comes from a mix of sources. The chart above illustrates the typical distribution of income streams retirees rely on and their tax implications.

1. Take Advantage of Tax-Deferred Accounts Strategically

Traditional IRAs and 401(k)s are tax-deferred accounts, meaning you didn’t pay taxes on your contributions but will pay taxes on withdrawals. To reduce your tax liability:

- Delay Withdrawals: If you can afford it, delay tapping into these accounts until required minimum distributions (RMDs) begin at age 73 (for those born in 1950 or later).

- Plan Your RMDs: Strategically manage your withdrawals to stay within a lower tax bracket.

Pro Tip: If you’re in a lower tax bracket early in retirement, consider withdrawing more than the RMD to reduce the account balance, lowering future tax obligations.

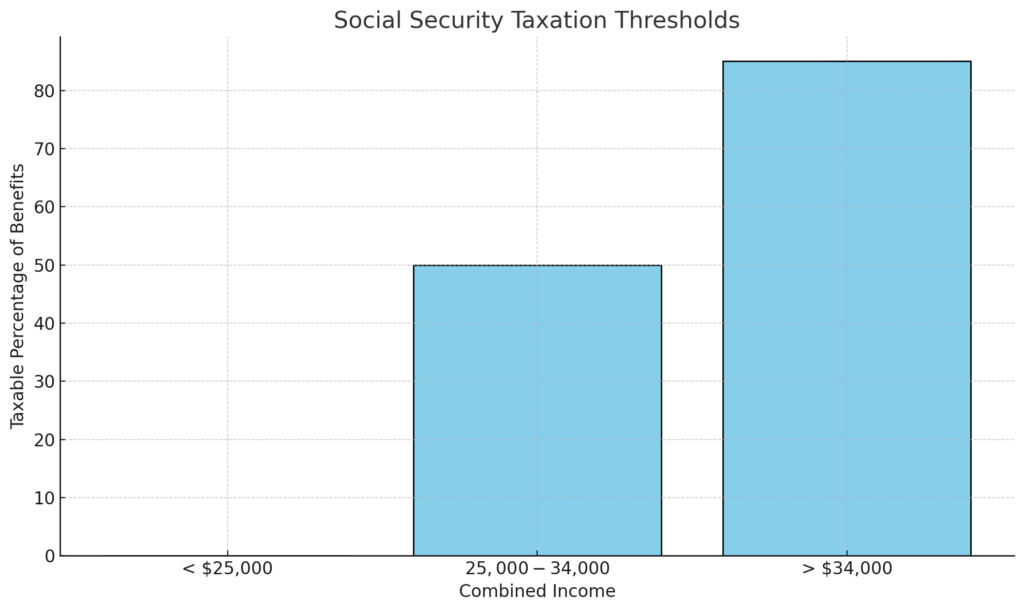

2. Consider Roth Conversions

A Roth IRA conversion involves transferring funds from a traditional IRA or 401(k) to a Roth IRA. While you’ll pay taxes on the converted amount in the year of the conversion, your future withdrawals will be tax-free.

- Benefits of Roth Conversions:

- Tax-free growth and withdrawals in retirement.

- No RMDs for Roth IRAs.

- Can reduce taxable income in later years.

Roth IRA conversions can provide significant tax benefits if timed correctly. Follow the flowchart above to understand the steps involved.

3. Utilize the Standard Deduction and Tax Credits

As a retiree, you may qualify for a higher standard deduction:

- 2023 Standard Deduction for Seniors: If you’re 65 or older, you receive an additional standard deduction of $1,500 (or $1,850 if single).

- Tax Credits: Look into credits like the Credit for the Elderly or Disabled, which can reduce your tax liability.

Using these deductions and credits wisely can help you save significantly.

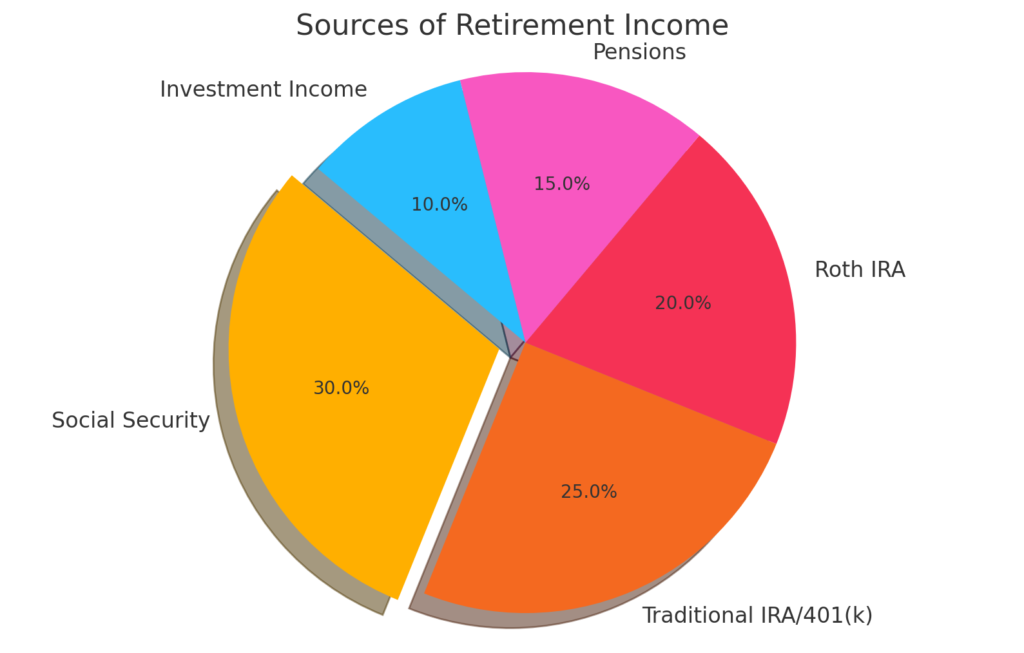

4. Manage Social Security Taxation

Social Security benefits may be taxed depending on your combined income (adjusted gross income + nontaxable interest + half of your Social Security benefits). To minimize Social Security taxes:

- Delay Benefits: Waiting until age 70 to claim Social Security increases your monthly benefits and can help you avoid higher taxation.

Withdraw Strategically: Draw from taxable accounts first to keep your combined income below the taxable threshold for Social Security.

Understanding how your combined income impacts Social Security taxation is crucial. The chart above shows the taxation thresholds and the percentage of benefits that may be taxed.

5. Leverage Health Savings Accounts (HSAs)

If you’re eligible for a Health Savings Account (HSA) and haven’t enrolled in Medicare yet, HSAs can be a valuable tax-saving tool:

- Contributions are tax-deductible.

- Growth is tax-free.

- Withdrawals for qualified medical expenses are tax-free.

HSAs can also be used in retirement to cover Medicare premiums, long-term care costs, and other medical expenses.

6. Optimize Charitable Contributions

If you’re charitably inclined, there are tax-efficient ways to give in retirement:

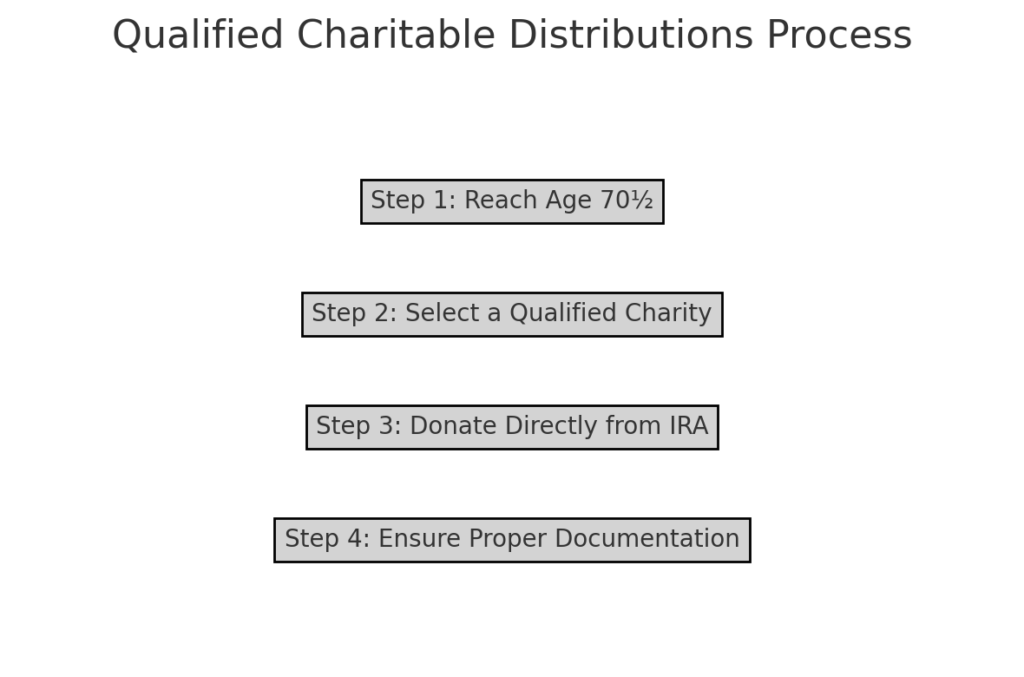

- Qualified Charitable Distributions (QCDs): Once you’re 70½, you can donate directly from your IRA to a qualified charity. The amount donated can count toward your RMD and isn’t included in your taxable income.

Bunching Donations: Combine multiple years’ worth of donations into one year to exceed the standard deduction and itemize deductions.

Qualified Charitable Distributions (QCDs) are a powerful tool for reducing your tax burden while supporting meaningful causes. The flowchart above explains the process.

7. Use Tax-Loss Harvesting

If you have taxable investment accounts, consider tax-loss harvesting:

- Offset capital gains with capital losses by selling underperforming investments.

- Use up to $3,000 of excess losses to reduce ordinary income.

This strategy is particularly effective for retirees managing diversified investment portfolios.

8. Consider Relocating to a Tax-Friendly State

State taxes can significantly impact your retirement income. Consider relocating to states with no income tax or retirement-friendly tax policies. Examples include:

- No State Income Tax: Florida, Texas, and Nevada.

- Tax Breaks for Retirees: States like Pennsylvania and Mississippi exempt retirement income from taxes.

Research each state’s policies on income, property, and sales taxes before deciding.

9. Plan Withdrawals from Taxable Accounts

Taxable accounts, such as brokerage accounts, offer flexibility:

- Withdrawals are taxed based on capital gains, which often have lower rates than ordinary income.

- Sell long-term investments to benefit from lower capital gains tax rates (0%, 15%, or 20%, depending on your income).

Use these accounts strategically to supplement income while keeping your tax liability low.

10. Work with a Tax Professional

Retirement tax planning can be complex, but a certified tax professional can help you:

- Develop a personalized strategy to minimize taxes.

- Stay compliant with tax laws and avoid penalties.

- Identify overlooked deductions and credits.

Investing in professional advice can save you thousands in the long run.

Final Thoughts

Planning for taxes in retirement is crucial for preserving your savings and ensuring financial security. By understanding how your income is taxed and leveraging strategies like Roth conversions, charitable giving, and tax-loss harvesting, you can significantly reduce your tax burden.

Take the time to assess your financial situation and develop a comprehensive tax strategy that aligns with your retirement goals. And remember, staying proactive and informed is the key to maximizing your income and enjoying a worry-free retirement.

Other Articles

10 Easy Fish Recipes for Seniors: Soft, Quick, and Nourishing

Fish is one of the easiest ways to enjoy lean protein, gentle textures, and brain-friendly omega-3s without spending hours in the kitchen. The 10 recipes below are written with seniors

Dating vs Companionship: What Are You Really Looking For?

With each passing year, our priorities and emotional needs change. For many seniors, the question isn’t just “Do I want to date again?” but rather “What am I truly looking

Managing Stress and Anxiety to Aid Sleep

Practical Relaxation Strategies for Seniors For many seniors, sleepless nights are caused less by physical discomfort and more by a restless mind. Worries about health, family, finances, or the changes

Hawaii Senior Communities

Arcadia Retirement Residence (Honolulu) – A premier Life Plan community with ocean views. Arcadia Retirement Residence is a distinguished Life Plan community located in the heart of Honolulu, Hawaii. Known

2025 Black Friday Deals For Seniors Can Take Advantage of Now

Black Friday 2025 arrived early, and seniors can now take advantage of some of the year’s most meaningful Amazon deals without waiting for Thanksgiving week. Whether you’re upgrading your tablet,

Senior Exercise: How to Stay Strong, Flexible, and Energized at Any Age

Movement isn’t just for the young. In fact, staying active becomes even more important as we get older — especially if we want to keep doing the things we love,